Investing in trenchless and pipe lining equipment from Internal Pipe Technologies has never been more rewarding! The Section 179 Tax deduction allows businesses to maximize their savings when purchasing our cutting-edge equipment before the end of the year. Don’t miss out on this incredible opportunity to enhance your operations while enjoying substantial tax benefits.

At Internal Pipe Technologies, we take pride in offering state-of-the-art trenchless and pipe lining solutions designed to revolutionize your operations:

Advanced Technology: Our equipment leverages the latest technology for efficient and precise results.

Durable and Reliable: Built to last, our products ensure long-term reliability and minimal downtime.

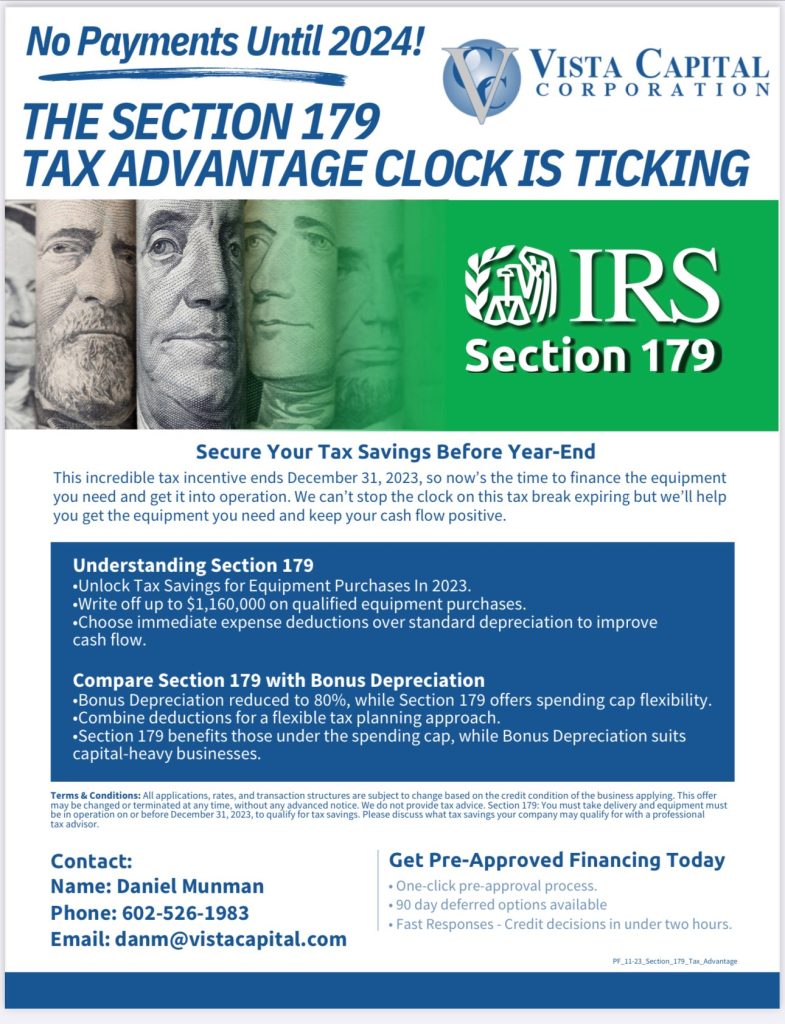

The Section 179 Tax deduction is available only until the end of the year. Act now to secure your tax savings and elevate your business with Internal Pipe Technologies’ top-of-the-line trenchless and pipe lining equipment.

Section 179 of the IRS tax code is designed to encourage businesses to invest in their growth by offering significant tax incentives for qualifying equipment purchases. By choosing Internal Pipe Technologies, you can deduct the full purchase price of your equipment from your gross income, up to a specified limit.

Internal Pipe Technologies materials and equipment are American-made and manufactured at our distribution facility. IPT is focused on under slab pipe lining and is solely committed to helping partners in this market. Backed by technology and support, IPT is taking the pipe lining industry to the next level.

Use the Section 179 Tax calculator to estimate your potential savings based on your Internal Pipe Technologies equipment investment.

Q: How does Section 179 work?

A: Section 179 is a tax deduction provision in the United States that allows businesses to deduct the full purchase price of qualifying equipment and/or software purchased or financed during the tax year. The purpose of Section 179 is to encourage businesses to invest in their own growth by providing a financial incentive for the acquisition of necessary equipment.

Q: Can I finance my Internal Pipe Technologies equipment purchase and still qualify for the deduction?

A: Yes, you can finance our pipe lining equipment! Check out this great offer from Vista Capital.

Have questions or need assistance? Our Internal Pipe Technologies team is here to help. Fill out the form below, and we’ll get in touch with you shortly.

Don’t miss out on the Section 179 Tax deduction – invest in Internal Pipe Technologies’ trenchless and pipe lining equipment today for a more profitable and efficient tomorrow!